Her savings account was opened few months after her baptism. We put all the money gifts given to her in that savings account including the money we got from selling her old stuffs.

I know you have a lot of questions in your mind. Let me answer them now.

Why invest rather than keep it in the bank?

- Saving in a bank is good for accumulation only but not for appreciation due to very minimal interest that it offers.

- Bank offers a guaranteed interest of 0.5% to 3% p.a. only

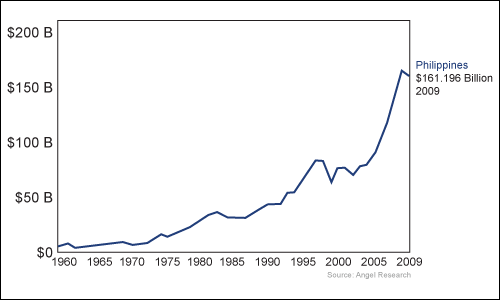

- Stock Market doesn't offer any guaranteed interest but money growth is averaging at 10% p.a.

- To generate future purchasing power and keep ahead of inflation which is averaging at 7%.

- My daughter will not be needing the money in the years to come.

Why in Stock Market?

- History has proven that investing in stocks over the long term provides greater returns and protection against inflation compared to other investment vehicles.

- Better gain if done correctly. Investing rather than trading.

- More Control on what company to buy rather than getting a Mutual Funds which are also investing in the stock market.

- Lesser commission charges. Commission is only charged upon buying and selling of stocks. Whereas in the Mutual Funds or other Managed funds, you were charged a certain management fee every year or every month depending on the Company.

- You own a Business without the headache. You share with their success but also share with their losses (Stock Value).

- Aside from the expected gain (capital appreciation), some companies give DIVIDENDS. This is a tiny part of the company's profit.

My husband and I agreed not to get an educational plan for my daughter due to the recent troubles encountered by the customers of Pre-need Companies. According to some report, about 29 other pre-need companies may end up like Prudential Plans Inc. We have already created a plan on how to maximize our investments to cater for both our retirement and educational plan of our daughter. With our computation, we can get her tuition fee from the earnings of her stock investments. Our plan is to invest every month on our daughters account. If in the future, we can manage not to touch our daughter's investment for her tuition fees, she will end up a multimillionaire. And if she continue investing in her account once she is already capable, she will be a billionaire at age 70. That is if she will not increase the amount that we are previously putting in her account. In case she will, she will be a billionaire earlier than 70 years old.

So far, this is our plan. Let's accumulate wealth and be a Blessing to Many!

To our Financial Freedom! Cheers!

To our Financial Freedom! Cheers!

PS:

If you have other questions, please leave a comment and I will try to answer you to the best of my ability.

If you have other questions, please leave a comment and I will try to answer you to the best of my ability.