Book Review:

The Turtle Always Wins

(How to Make Millions in he Stock Market)

Author: Bo Sanchez

Last March 18,2012 after The Feast in PICC, Bro. Bo Sanchez launched his new book about Investing in the Stock Market. It is a follow-up of his book

" My Maids invest in the Stock Market".

As you can read from my previous posts, I am also promoting

Investing in the Stock Market.The moment I got hold of the book, I couldn't let it off my hands. I started reading it while in the car and finished it at home.

It was a such a great book. I am happy that there are now books available in bookstores discussing Investing in the Stock Market in Layman's Term. The words and stories used by Bo made Investing in the Stock Market simple and understandable.

The book discussed the need to invest and compared the different people found in the Stock Market. Bro. Bo compared them to 4 different animals such as a squirrel, rabbit, sloth and a turtle.

Chapter 1 of the Book (Plant in the Spring or Beg in the Fall) was successful in setting up the mood to convince Filipinos to invest for our retirement. Bo narrated the story of two grandmothers who had different strategies on handling money during their younger years and how it affected their old age.

Lola Penny was a CPA who worked in a company for 38 years. She saved for big expenses but failed to save for her retirement. She relied on her company's retirement package. After retiring, she got 3M. She was not good in handling it so after 7 years, it was totally wiped out. She started depending on her children who also had problems financially. She even heard her daughter complaining to her "kuya" about the money she spent for their mother's medicines. This one really broke her heart.

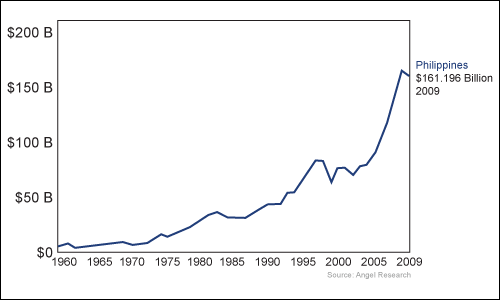

On the other hand, Lola Pilar worked as a cashier in a music store for 19 years. She got a separation fee of P2000 which she invested in the stock market in 1966. She also put add'l money in the stock market whenever she had extra. She and her husband only invest in giant companies. They sold portions of the investment little by little for big expenses. At age 85, she withdraw everything and got an oozing P 1.2M. She became a millionaire through the stock market.

Bro. Bo emphasized that God gave us a choice and ability to create wealth. If we retire in poverty, it is not God's fault.

In chapter 2, Bro. Bo said that we can be rich. But it would be better if we can take others along to richness. If we follow the turtle strategy, it is not impossible for us to get rich.

Bro. Bo compared Investing in the stock Market with a RACE. The four different People in the Stock Market are the Animal Runners.

In the Story, the Turtle won first place. The Rabbit got the 2nd place. The sloth was 3rd while the squirrel was a no show. No one really knows what happened to him. Some say, he got lost and was killed by a bear.

Squirrel is the Typical Trader.

It represents the newbie who gets into the stock market without understanding what he's getting into. It also represents the old-timer in the stock market. He earns some and loses some. It represents the 85% of people who get into the stock market and lose their money.

They want excitement. They look at their stock portfolio everyday. They buy now and sell a few days later or something within the day. They don't follow the rules and try to take a lot of shortcuts. They are the typical gamblers

Some of them are devious. They fool other traders. They tell their friends to buy a certain hot stock, and when the price goes up, they'll sell and leave their friends an empty bag.

These typical traders can get lost in their trading and get killed by a bear market.

Rabbit is the Trained Trader.

Rabbits are also traders but trained. Trading is their full-time job. They follow very strict rules like:

1. They don't buy penny stocks. Only Giants.

2. They don't put more than 5% of their money in a specific stocks.

3. They never end a trading day with more than 30% of their money in the stock market to avoid surprises. They are still conservative.

Some rabbits break rules once in a while. Temptation is high on the floor. And because of these they only won second place. Because they lose part on their earnings along the way.

Sloth is the Typical Investor.

Sloth is a typical investor who buys and hold. He parks his money in a stock market and forget about it. Usually it's a huge amount of money. One time, Big Time.

According to Bro. Bo, it is a good strategy but not the best. It is recommended but with few conditions mentioned below:

1. You need to have a big chunk of money.

2. You need to buy a basket of great companies that you believe will be great for the next 20 years.

3. You have to buy when the market is down or flat.

4. You got to reinvest the dividends.

Turtle is the Trained Investor.

A Turtle investor does the most boring investment strategy in the world. He invests small amounts of money each month in great companies. He doesn't care is the market is up or down. He invests regularly and puts more money when the market is down.

Their goal is to earn 12% to 20% each year over a 20 year period.

HOW the TURTLE Beats the SLOTH?

- by reinvesting the dividends. Call it compounding.

HOW the TURTLE Beats the RABBIT?

- Rabbits will always be partially invested. Turtles are almost always invested. He can take advantage of the compounding effect.

HOW to FOLLOW the TURTLE?

1. Turtle lives below its means.

- Your expense should grow slower than your income.

2. Turtle builds his farm before his home.

- Secure your livelihood before your lifestyle.

- Establish your income stream before your expense stream.

- The perfect time to invest is when your money is still very scarce.

3. Turtle Invests his windfalls

- Aside from the regular habit of investing 20% of your income, also invest windfalls like bonuses, commissions, cash gifts and profits from side businesses.

4. Turtle Invests when its difficult to invest.

- Build wealth when everyone is afraid.

- Invest even if there are crisis.

5. Turtle Works in Cash Machines, Not Stocks

- You can't invest in the stock market if you don't have a cashflow.

- Spend 99% of your time on your business. Create your cashflow. Increase and Multiply it.

- Then spend 1% of your time investing that cashflow in the stock market.

6. Turtle Believes He'll Win

- You need

Wealth Competence but more importantly

Wealth Consciousness.

- Mind first then Reality.

LAW#1 You will gravitate towards what you unconsciously desire.

LAW#2 What you can see, you can create. What you cannot see, you cannot create.

The TURTLE has a name. We call him SAM.

SAM is an acronym for

Strategic Averaging Method.

It is semi-passive investing

SAM is passive investing with a little bit of "cheating" or "timing".

Five Rules of Passive Investing

1. Invest monthly for 20 years or more.

2. Invest even when there's a crisis.

3. Invest only in giants.

4. Invest in many giants.

5. Buy when the price is beneath our "Buy Below Price". Sell when the price is near our "Target Price"

Three Big Advantages of SAM

1.

Faster Giants - Lesser Choices

2. Lower Prices - Buying at cheaper price. Make money when you buy. This prevents chasing a rising stocks.

3. Secured Profits - Lock your profits from a company that gone up and reinvest the proceeds to another company that has still room to grow.

At the end of the book, Bro. Bo invited the readers to become a member of the

Truly Rich Club to maximize your earning potential in the stock market.

Truly Rich Club Members gets Bro. Bo's Stock Update eReport, Wealth Strategies Newsletter and Stock Alerts.

I am a member of the

Truly Rich Club for 2 years now. And it was all worth it. The membership fee I pay monthly is very little compared to the profits and gain I got following Bro. Bo Stock Alerts. I do believe (like the Turtle) that

We Can Win if we follow these Rules mentioned in the Book.

I highly recommend this book!!!

In Summary:

Price: Php 225 only (got mine for only Php200 during the book launch)

Content: Super Check

Recommended: Super Check

.jpg)